All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The landscape is shifting. As rates of interest decrease, taken care of annuities might shed some charm, while products such as fixed-index annuities and RILAs gain traction. If you remain in the marketplace for an annuity in 2025, store thoroughly, contrast choices from the finest annuity firms and focus on simplicity and transparency to discover the appropriate suitable for you.

When choosing an annuity, economic strength ratings issue, however they don't tell the whole tale. Below's just how compare based upon their ratings: A.M. Ideal: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Best: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Ideal: A+ Moody's: A1 Requirement & Poor's: A+ Comdex: A greater economic score or it only shows an insurance company's financial toughness.

A lower-rated insurer may supply a, resulting in substantially more earnings over retired life. If you focus just on rankings, you might The finest annuity isn't nearly business ratingsit's around. That's why comparing actual annuity is much more important than simply looking at financial toughness scores. There's a lot of sound available when it involves financial recommendations about annuities.

That's why it's necessary to obtain suggestions from somebody with experience in the industry. is an staffed by independent qualified financial professionals. We have years of experience aiding individuals find the appropriate items for their requirements. And because we're not connected with any kind of business, we can give you unbiased advice concerning which annuities or insurance plan are ideal for you.

We'll aid you sort through all the options and make the ideal choice for your circumstance. When choosing the finest annuity firms to advise to our customers, we use a thorough method that, then from there that includes the following standards:: AM Finest is a customized independent score firm that reviews insurance firms.

And bear in mind,. When it pertains to fixed annuities, there are many options available. And with many selections, understanding which is appropriate for you can be difficult. There are some points to look for that can assist you tighten down the field. First, opt for a highly-rated firm with a strong online reputation.

Voya Annuity Phone Number

Choose an annuity that is simple to understand and has no gimmicks.

Some SPIAs offer emergency situation liquidity includes that we such as. If you seek an immediate earnings annuity, take into consideration set index annuities with an ensured life time earnings rider and start the income promptly. Annuity owners will have the flexibility to turn the retirement earnings on or off, accessibility their cost savings, and have the ability to stay on par with inflation and earn passion while getting the earnings permanently.

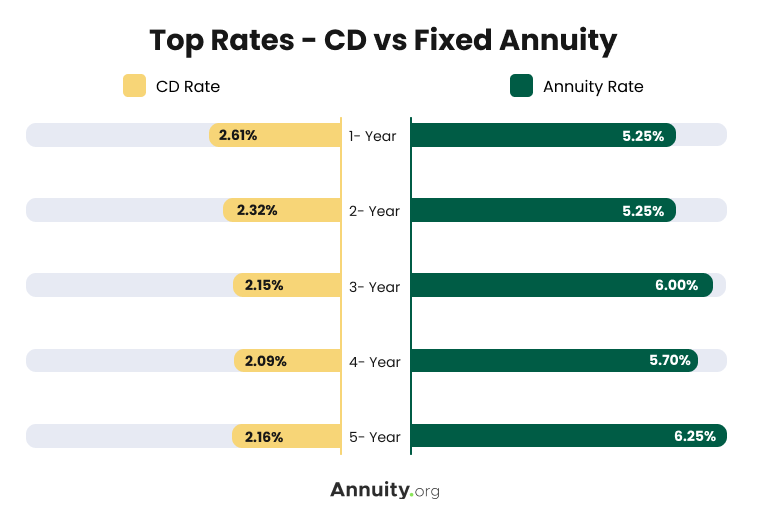

There are a few key factors when looking for the ideal annuity. Contrast passion prices. A higher interest rate will offer even more development capacity for your financial investment.

This can promptly improve your financial investment, however it is necessary to recognize the terms affixed to the benefit before spending. Assume regarding whether you want a life time revenue stream. This kind of annuity can supply tranquility of mind in retired life, but it is vital to guarantee that the revenue stream will certainly be sufficient to cover your needs.

These annuities pay a fixed month-to-month amount for as lengthy as you live. And even if the annuity runs out of cash, the regular monthly settlements will certainly continue coming from the insurance policy company. That implies you can rest very easy knowing you'll always have a constant revenue stream, no matter for how long you live.

Annuity Training Course

While there are a number of different kinds of annuities, the finest annuity for long-lasting care costs is one that will spend for many, if not all, of the expenses. There are a few points to take into consideration when choosing an annuity, such as the length of the agreement and the payment alternatives.

When choosing a fixed index annuity, compare the available items to discover one that best matches your needs. Athene's Performance Elite Series American Equity AssetShield Series Athene Agility Fixed Indexed Annuity is our top choice for tax obligation deferral for numerous factors. Enjoy a lifetime revenue you and your spouse can not outlive, providing economic security throughout retirement.

Nationwide Annuity Surrender Form

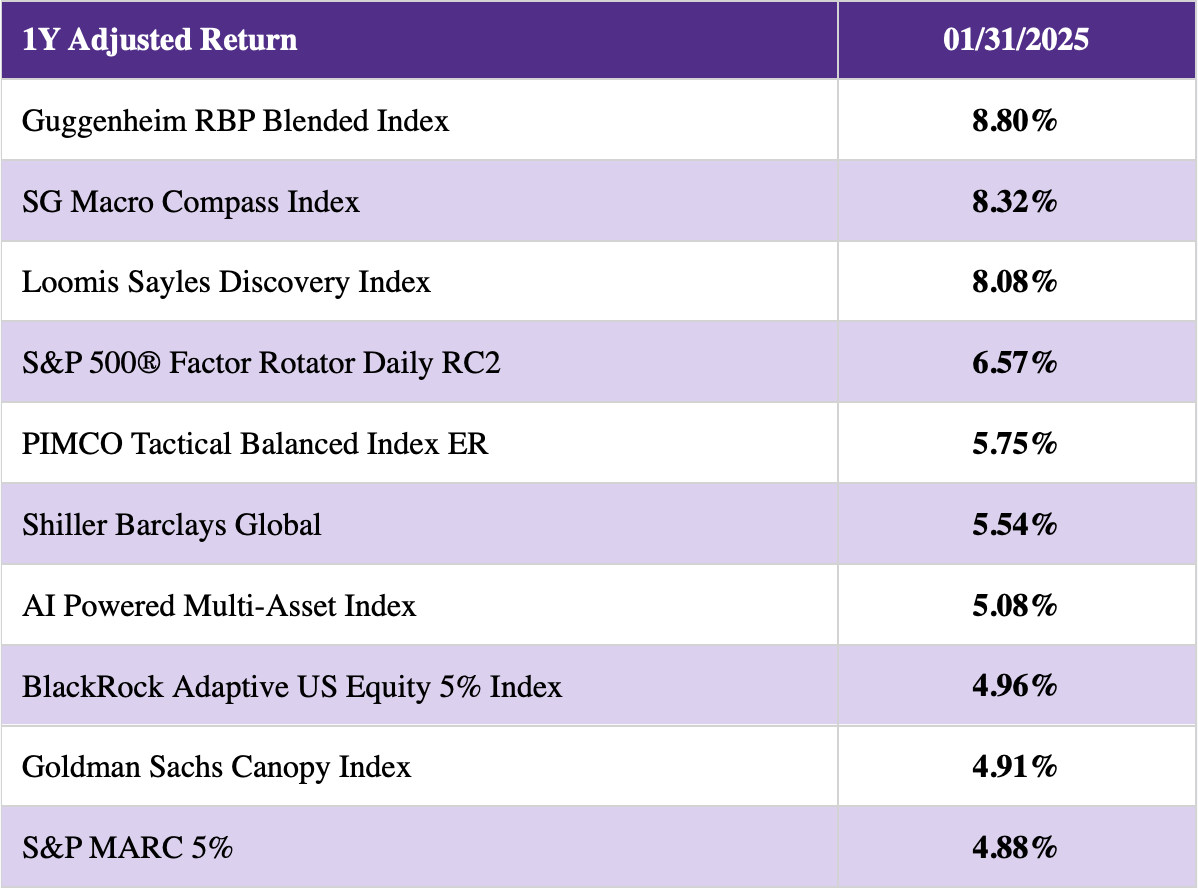

These annuities show the highest possible returns (hypothetically). The picture listed below is a fragment from my annuity to provide you a much better idea of returns. There are a few crucial factors to consider when locating the finest annuities for elders. Based on these requirements, our referral for the would be American National. On top of that, they permit up to 10% of your account value to be withdrawn without a fine on the majority of their item offerings, which is higher than what most various other insurer enable. Another consider our recommendation is that they will certainly allow elders approximately and including age 85, which is also greater than what some other business enable.

The very best annuity for retired life will depend upon your individual needs and objectives. Nevertheless, some features prevail to all appropriate retirement annuities. An ideal annuity will give a steady stream of income that you can depend on in retirement. It needs to likewise provide a secure financial investment choice with potential development without threat.

Lincoln Index Annuity

They are and regularly supply some of the highest payments on their retired life revenue annuities. While rates change throughout the year, Fidelity and Guarantee are typically near the top and maintain their retired life incomes competitive with the various other retired life earnings annuities in the market.

These rankings offer consumers a concept of an insurance provider's monetary security and exactly how likely it is to pay on cases. It's important to note that these scores do not necessarily mirror the top quality of the items offered by an insurance policy firm. For instance, an "A+"-rated insurance provider might provide products with little to no development capacity or a reduced income forever.

Nevertheless, your retirement savings are most likely to be one of the most vital financial investments you will ever make. That's why we just suggest dealing with an. These firms have a proven record of success in their claims-paying ability and offer lots of functions to assist you fulfill your retired life objectives."B" rated business should be stayed clear of at mostly all costs. If the insurer can't obtain an A- or better ranking, you should not "bet" on its capability long-term. Surprisingly, several insurer have been around for over half a century and still can not acquire an A- A.M. Best ranking. Do you wish to gamble cash on them? If you're seeking lifetime income, stick to assured income motorcyclists and avoid performance-based earnings bikers.

Table of Contents

Latest Posts

Annuity Sales Leads

Annuity Guys

Contingent Deferred Annuities

More

Latest Posts

Annuity Sales Leads

Annuity Guys

Contingent Deferred Annuities